Fintechzoom.com Nasdaq: Real Time Stocks, News & Market Analysis

Investing in the Nasdaq can feel overwhelming—too much noise, not enough clarity. With tech stocks swinging daily and financial headlines changing by the hour, it’s hard to know where to focus. You want timely insights, simplified data, and a smarter way to track market shifts.

That’s where Fintechzoom.com Nasdaq steps in. It bridges the gap between Nasdaq’s high-speed market and everyday investors like you. Whether you’re watching AI stocks, growth tech, or sustainable sectors, Nasdaq FintechZoom gives you real-time updates, expert-backed trends, and actionable data—all in one place. It’s your go-to source to stay ahead in a fast-changing Market.

What is Fintechzoom.com Nasdaq?

Many investors struggle to track Nasdaq updates in real time. The data often feels scattered, delayed, or too complex to act on. You want quick, reliable market insights but don’t know where to look. Missing key stock movements or acting on outdated data can cost real money. Traditional sources don’t offer live analysis or user-friendly tools, leaving you stuck and guessing.

That’s where FintechZoom.com gives you an edge. We bring you real-time Nasdaq data with clear, simple tools. You get live charts, stock trends, and financial news—all in one place. FintechZoom breaks down complex market info into insights you can use. Whether you’re new to investing or a pro, we help you stay informed, confident, and ahead of the curve.

| NASDAQ Key Stats | Details (with Sources) |

| NASDAQ Stands For | National Association of Securities Dealers Automated Quotations |

| Overview | Global electronic stock-exchange headquarters |

| Founded | February 8, 1971 |

| Key Indices | Nasdaq-100, Nasdaq Composite |

| Listed Companies | Over 5,000 companies |

| Primary Focus | High-growth, fully electronic marketplace |

| Popular Sectors | Biotech, Fintech, Consumer Services, Global Indices, Tech Innovators |

| Top Composite Members | Apple, Tesla, Amazon, Microsoft, Alphabet (Google), Meta Platforms |

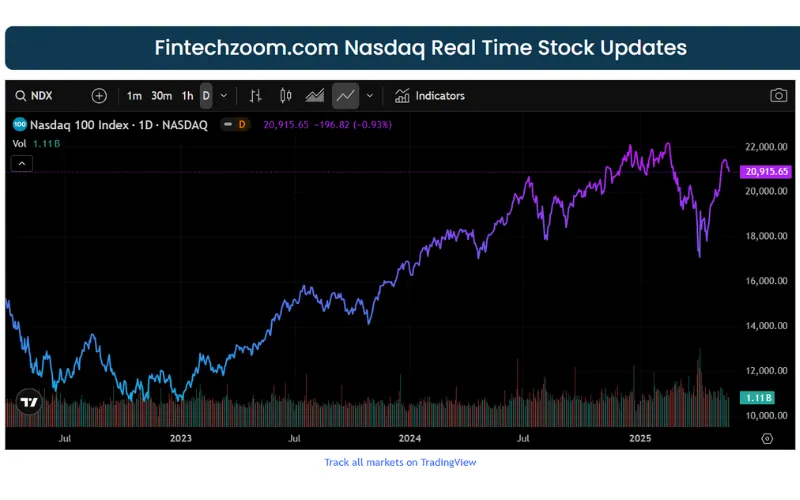

Fintechzoom.com Nasdaq Real Time Stock Updates

Key Nasdaq Indices on FintechZoom Nasdaq

Nasdaq Composite

This index tracks over 3,000 companies listed on the Nasdaq, offering a full snapshot of the tech-heavy market. On FintechZoom, you can follow daily performance, top gainers/losers, sector rotation, and investor sentiment—all in one place.

Nasdaq-100

FintechZoom highlights this elite index of the top 100 non-financial companies on the Nasdaq, including giants like Apple, Microsoft, and Meta. You’ll find real-time charts, volatility trends, and deep dives into earnings drivers—perfect for high-level strategic investing.

Other Top FintechZoom Stocks

Investment Portfolio Consultation of Nasdaq FintechZoom

Managing your investment portfolio without expert guidance can feel overwhelming. You face risks from market changes, scattered data, and unclear strategies. Poor decisions often result in missed opportunities or losses.

That’s why FintechZoom offers smart Nasdaq-based portfolio consultations. We help you align your assets with market trends and goals. You get expert-backed insights to make informed, low-risk investment moves. With us, you plan smarter and stay in control.

NASDAQ Stock Research Tools

Finding reliable Nasdaq research tools is tough when you’re bombarded with noisy platforms. Many sources lack real-time data or are too complex to use daily.

FintechZoom simplifies your stock research experience. We provide live Nasdaq charts, price alerts, and AI-based analysis. You can compare trends, review financials, and track top-performing stocks—all in one dashboard.

Founding and Growth of Nasdaq FintechZoom

FintechZoom began with one mission—make financial data simple, fast, and accessible. It started as a news platform focused on finance and investing trends.

Over time, it evolved into a complete financial intelligence hub. Today, FintechZoom helps thousands of users analyze Nasdaq, crypto, and other key markets. Its rapid growth comes from blending real-time insights with easy-to-use tools.

Who Benefits from Fintechzoom.com Nasdaq?

Individual Investors

You want smart, fast decisions—but lack time to read long reports. FintechZoom filters Nasdaq updates, helping you act quickly and confidently. You save time while staying ahead.

Fintech Enthusiasts

If you love exploring financial innovation, FintechZoom is your playground. We blend Nasdaq analysis with tech-forward tools and trend alerts. It’s perfect for curious, data-driven minds.

Crypto Traders

Nasdaq moves often affect crypto market behavior. FintechZoom lets you track both in real time. You spot cross-market patterns faster and make better trade decisions.

Business Owners

Your business may depend on market timing, supply chains, or sector performance. FintechZoom gives you Nasdaq-driven financial insights tailored for smarter business decisions.

Fintechzoom.com Nasdaq: Market Trends and Investment Opportunities in 2025

Navigating the Nasdaq in 2025 means staying ahead of fast-moving sectors like AI, fintech, and green tech. But without real-time insights, you risk missing the trends that shape the year’s biggest gains.

FintechZoom helps you cut through the noise. It tracks Nasdaq-listed companies using live data, predictive analytics, and sentiment tools. You don’t just see stock prices—you see what’s driving them.

Key growth trends include:

With Fintechzoom.com Nasdaq tools, you can spot these shifts early and act confidently. Whether you’re a growth investor or risk-conscious trader, 2025 offers real opportunities—if you know where to look.

Updated Nasdaq FintechZoom Pricing Plans

| Plan | Features | Price (per month) |

| Starter Plan | Free access to news and educational resources | $1.50 |

| Essential Plan | Options trading, real-time data, extended hours trading | $7.49 |

| Investor Plus | Includes Essential features + level II quotes, research reports | $12.49 |

| Advanced Pro | All Investor Plus features + margin trading, streaming news | $23.49 |

Why Choose Nasdaq FintechZoom?

Expanded Competitors in the Fintechzoom.com Nasdaq Industry

| Competitor | Primary Focus |

| Finance Magnates | Forex and cryptocurrency analysis |

| The Motley Fool | Stock tips and long-term investment strategies |

| Forbes Fintech | Industry news and market trends |

| Yahoo Finance | General financial news and data |

| Morningstar | Investment research and stock analysis |

| Crunchbase | Company data, tech news, and market insights |

| MarketWatch | Financial news and stock market updates |

| The Fintech Times | Fintech industry developments and insights |

Fintechzoom.com Nasdaq Features

Real-Time Stock Market Data

You don’t have time to wait when markets move fast. That’s why FintechZoom gives you real-time Nasdaq quotes with millisecond-level accuracy. We pull live data directly from Nasdaq’s electronic feed, so you’re always trading on the freshest numbers—no lags, no delays. Whether you’re monitoring pre-market spikes or reacting to breaking news, you stay one step ahead.

Refined Charting and Analysis Instruments

We know serious traders need more than just basic charts. Fintechzoom.com Nasdaq delivers advanced technical indicators like Bollinger Bands, MACD, RSI, and Ichimoku Cloud, all inside an easy-to-use interface. You can also overlay earnings dates, trend lines, and volume markers. Every tool is designed to help you make confident, data-backed decisions.

Crypto Market Insights

FintechZoom isn’t just for stock traders. You also get real-time updates on the crypto markets, including Bitcoin, Ethereum, and tokenized Nasdaq assets. We highlight price trends, on-chain metrics, and market sentiment so you can watch how crypto movements influence Nasdaq stocks—and vice versa. It’s a complete view of both digital and traditional finance.

Fintech News and Trends

You shouldn’t have to dig through thousands of headlines to find what matters. FintechZoom uses AI-powered filtering to deliver breaking fintech and Nasdaq news that actually impacts the market. From fintech startup IPOs to major regulatory shifts, we give you curated, relevant updates so you act fast and smart.

Portfolio Management Tools

Managing multiple investments across sectors and asset classes? FintechZoom’s tools let you track your entire portfolio in one place. Monitor performance, risk exposure, sector breakdown, and asset correlation. You can set alerts for price changes, news triggers, or earnings reports—so your strategy stays aligned, even when markets shift.

Educational Resources

New to investing? Or just looking to sharpen your strategy? FintechZoom offers clear, practical tutorials on everything from Nasdaq options trading to crypto wallet security. No fluff, no jargon. Just simple guides that make financial literacy accessible—because we believe informed investors make better decisions.

Comprehensive Financial News

Markets are global, and your news should be, too. FintechZoom gives you up-to-date financial coverage from Nasdaq, Wall Street, and global exchanges. We go beyond headlines to explain why things matter—whether it’s a Fed rate change, earnings surprise, or tech-sector rotation.

Fintechzoom.com Nasdaq News, Mission & Price Prediction

FintechZoom’s newsroom filters thousands of Nasdaq filings, press releases, and social chatter every hour, surfacing only market‑moving headlines. Our mission is clearly to help you turn raw information into precise price forecasts using AI‑powered modeling and seasoned human oversight. You get probability‑based projections, not vague guesses.

Key Takeaways of Nasdaq

Nasdaq’s Influence on Fintech

Nasdaq’s History and Role in Tech Stock Growth

Since its founding in 1971, Nasdaq has revolutionized how technology companies access capital. By offering a fully electronic trading platform, Nasdaq attracted innovators early—giving rise to legendary IPOs like Apple, Microsoft, and Amazon. This digital-first model reduced barriers, cut listing costs and made it easier for high-growth tech firms to scale fast.

Nasdaq-Listed Fintech Companies

Fintech leaders like PayPal, Coinbase, Intuit, and Robinhood are listed on Nasdaq. These companies don’t just benefit from visibility—they gain credibility, liquidity, and access to a massive investor base.

Nasdaq Data Drives Fintech Solutions and Platforms like FintechZoom

FintechZoom pulls real-time data directly from Nasdaq to power its tools and insights. This data enables features like live charts, earnings reports, and automated portfolio analysis. Without Nasdaq’s deep data feeds, platforms like FintechZoom couldn’t deliver the speed, accuracy, or depth that modern investors demand.

The Future of Nasdaq and FintechZoom

Nasdaq’s Evolution in Fintech

Nasdaq doesn’t stand still. It’s investing in blockchain infrastructure, AI-driven compliance systems, and tokenized assets. Its acquisition of fintech firms and expansion into cloud-based trading services signal a deeper commitment to digital innovation across all sectors of finance.

The Future of Fintechzoom

FintechZoom is evolving into a full-scale financial intelligence platform. Expect more personalized AI tools, deeper coverage of emerging assets like tokenized stocks, and interactive dashboards that learn from your trading habits. The goal? Make finance simpler, smarter, and tailored to you.

Synergies Between Nasdaq and FintechZoom

Together, both Nasdaq and FintechZoom are so powerful. Nasdaq supplies the market data and infrastructure; FintechZoom refines it into actionable insight. This synergy creates faster research, smarter investment tools, and a more seamless experience for everyday investors and professionals alike.

Influence on the Financial Ecosystem

As Nasdaq modernizes the core of capital markets and FintechZoom democratizes access to financial data, their combined impact is massive. Together, they break down information barriers and bring Wall Street-level tools to Main Street users.

Sample of Fintechzoom.com Nasdaq Stocks

| Adobe Inc. | Alexion Pharmaceuticals | Align Technology | Alphabet Inc. (Class A) |

| Alphabet Inc. (Class C) | Amazon.com, Inc. | Amgen Inc. | Analog Devices, Inc. |

| Apple Inc. | Applied Materials | ASML Holding | Atlassian Corporation |

| Autodesk, Inc. | Automatic Data Processing | Baidu, Inc. | Biogen Inc. |

| BioMarin Pharmaceutical | Broadcom Inc. | Cadence Design Systems | CDW Corporation |

| Cerner Corporation | Check Point Software | Cintas Corporation | Cisco Systems, Inc. |

| Citrix Systems, Inc. | Comcast Corporation | Copart, Inc. | Costco Wholesale |

| CrowdStrike Holdings | DexCom, Inc. | Dollar Tree, Inc. | eBay Inc. |

| Electronic Arts Inc. | Exelon Corporation | Fastenal Company | Facebook, Inc. |

| Fiserv, Inc. | Fox Corporation (Class A) | Fox Corporation (Class B) | Gilead Sciences, Inc. |

| Hasbro, Inc. | Illumina, Inc. | Intel Corporation | Intuit Inc. |

| Intuitive Surgical, Inc. | JD.com, Inc. | KLA Corporation | Kraft Heinz Company |

| Lam Research | Liberty Global (Class C) | Lululemon Athletica | Marriott International |

| Maxim Integrated | Mercadolibre, Inc. | Microchip Technology | Micron Technology |

| Microsoft Corporation | Mondelez International | Monster Beverage | NetEase, Inc. |

| NVIDIA Corporation | NXP Semiconductors | O’Reilly Automotive | Paychex, Inc. |

| PayPal Holdings | Peloton Interactive | Pinduoduo Inc. | Qualcomm Inc. |

| Regeneron Pharmaceuticals | Ross Stores, Inc. | Sirius XM Holdings | Splunk Inc. |

| Starbucks Corporation | Synopsys, Inc. | T-Mobile US, Inc. | Take-Two Interactive |

| Tesla, Inc. | Texas Instruments | Verisk Analytics | Vertex Pharmaceuticals |

| Walgreens Boots Alliance | Warner Music Group | Workday, Inc. | Xcel Energy Inc. |

Conclusion

Navigating Nasdaq’s tech-driven exchange can feel overwhelming amid constant market shifts. With Fintechzoom.com Nasdaq , you get real‑time data, AI‑powered insights, and a user‑friendly hub that turns raw numbers into clear investment opportunities. Whether you’re tracking AI stocks, exploring fintech ETFs, or diving into blockchain trends, FintechZoom equips you to make confident decisions fast. Start your journey today and transform volatility into your advantage.