FintechZoom Apple Stock: Real Time Market Insight 2025

Many investors struggle to keep up with Apple’s stock movements. The market shifts fast, and missing updates can cost you. You may find it hard to filter reliable insights from the noise, especially with tech stocks like Apple. Without real-time data and clear analysis, making smart investment decisions becomes a challenge.

That’s where FintechZoom Apple Stock step in. This guide, powered by FintechZoom’s tools and insights—helps you stay ahead with the market trend. We break down Apple’s financials, trends, and forecasts using the latest data. If you’re new to investing or managing a portfolio, you’ll find high-quality, understandable information here.

Overview of Apple Inc. rice

Apple Inc. stands as a global tech powerhouse. Founded in 1976, it’s known for innovation. The company delivers cutting-edge products and seamless digital experiences worldwide. Apple’s model combines hardware, software, and services in one ecosystem. This ensures user loyalty. You’ll find Apple in nearly every country. Its reach spans retail, supply chains, and online services.

Key Financial Metrics

Revenue: Apple earned over $383 billion in revenue in fiscal 2023. Profit: Its net income surpassed $97 billion, showing strong financial health.

Market Capitalization: Apple’s market cap floats around $2.6 trillion in early 2025. Why It Matters: These numbers prove Apple’s dominance and investor confidence.

Today’s Apple FintechZoom Stock (Real Time) chart

To check the real-time Apple FintechZoom today, type ‘Apple’ in the chart box:

Other Top FintechZoom Stocks

Apple’s Business Segments

iPhone

The iPhone drives most of Apple’s revenue. It continues to lead global smartphone innovation.

iPad

iPad sales fluctuate but remain popular in education and enterprise use cases.

Mac

The Mac lineup has grown with custom chips. Creative professionals still prefer Macs.

Wearables, Home, and Accessories

Apple Watch, AirPods, and smart home products see steady demand and ecosystem synergy.

Services

Services include iCloud, Apple Music, and the App Store. This segment boosts recurring revenue.

FintechZoom Apple Stock: A Vital Resource for Investors

Real-Time Stock Quotes

FintechZoom.Com offers live Apple stock prices. You can track every market move instantly.

News and Analysis

You get daily financial news and detailed analysis tailored to AAPL stock.

Financial Reports

FintechZoom simplifies quarterly earnings and key financial statements for quick understanding.

Technical Analysis Tools

You can access charts, trend lines, and volume indicators directly on the platform.

Community Insights

Join investor forums to exchange insights, strategies, and sentiment around Apple stock.

FinTech Zoom’s Analysis of Apple Stock

FintechZoom highlights Apple’s resilience amid global tech volatility. It praises Apple’s innovation, strong earnings, and loyal user base.

You get a comparison of Apple vs Microsoft, Alphabet, and Amazon in real-time. FintechZoom notes Apple’s steady growth and superior product pipeline.

Apple Stock Historical Performance

Apple’s 5-year chart shows strong growth despite economic ups and downs. The 1-year performance remains steady, supported by iPhone upgrades and service revenue.

Apple went public in 1980. Since then, it’s split its stock five times. Milestones include the launch of the iPhone and becoming the first $1T company.

Apple often outperforms the S&P 500. It also leads most tech peers in returns.

Factors Influencing FintechZoom Apple Stock

Product Launches

New product cycles directly affect Apple’s stock price and investor sentiment.

Earnings Reports

Strong quarterly reports often trigger bullish trends. Weak ones spark sell-offs.

Market Trends

Macroeconomic conditions like inflation or interest rates also impact AAPL’s valuation.

Competition

Samsung, Microsoft, and others create pressure on Apple’s innovation and pricing.

Regulatory Environment

Global antitrust issues and data privacy laws affect Apple’s long-term strategies.

Current Market Sentiment

Most analysts rate AAPL as a “Buy” or “Hold” in early 2025. FintechZoom sentiment tools show a majority bullish investor outlook. Institutional investors continue to increase their Apple holdings. You can also take a look at FintechZoom’s Best Travel Credit Card for traveling.

Apple Stock: Strengths and Weaknesses

Bull Case and Innovation

Apple leads in custom chips, AR/VR tech, and AI integration.

Strong Balance Sheet

It holds massive cash reserves, low debt, and solid free cash flow.

Ecosystem

Seamless device integration boosts user retention and recurring purchases.

Bear Case and Valuation

High P/E ratios raise concerns about future return potential.

Regulatory Risk

Lawsuits and investigations pose a risk to global operations.

Supply Chain

Geopolitical tensions and delays can disrupt Apple’s hardware delivery.

Investment Considerations in 2025

Apple remains a top pick for long-term tech investors. Its growth potential is strong, but valuation and global risks must be weighed. Consider AAPL if you want stable growth and low volatility exposure.

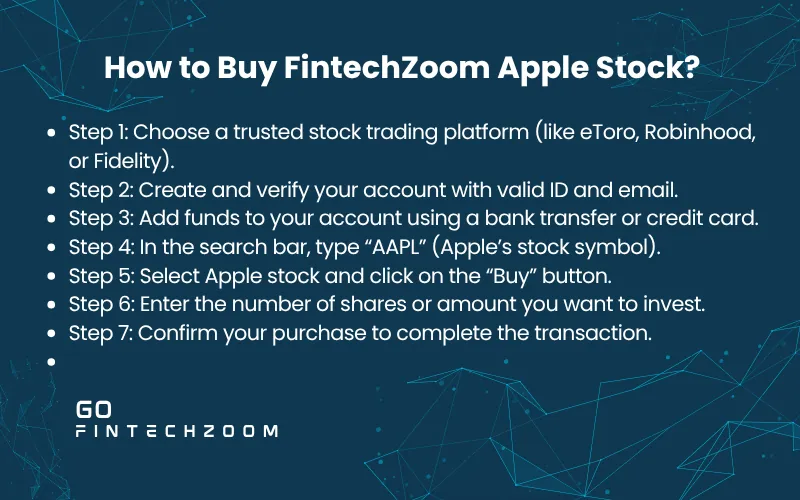

How to Buy FintechZoom Apple Stock?

You can buy AAPL through platforms like E*TRADE, Fidelity, or Robinhood. FintechZoom recommends comparing fees, tools, and ease of use before investing.

If you’re new, start small and diversify. Learn market basics through FintechZoom’s beginner guides.

Conclusion

Apple remains a tech leader with strong fundamentals and global impact. FintechZoom Apple Stock offers the tools and data you need to stay informed. If you’re tracking AAPL in 2025, this platform gives you a clear edge. Stay connected, and let FintechZoom guide your next investment move.